The Only Guide for Mileagewise - Reconstructing Mileage Logs

Table of ContentsNot known Details About Mileagewise - Reconstructing Mileage Logs Some Known Details About Mileagewise - Reconstructing Mileage Logs How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get ThisRumored Buzz on Mileagewise - Reconstructing Mileage Logs

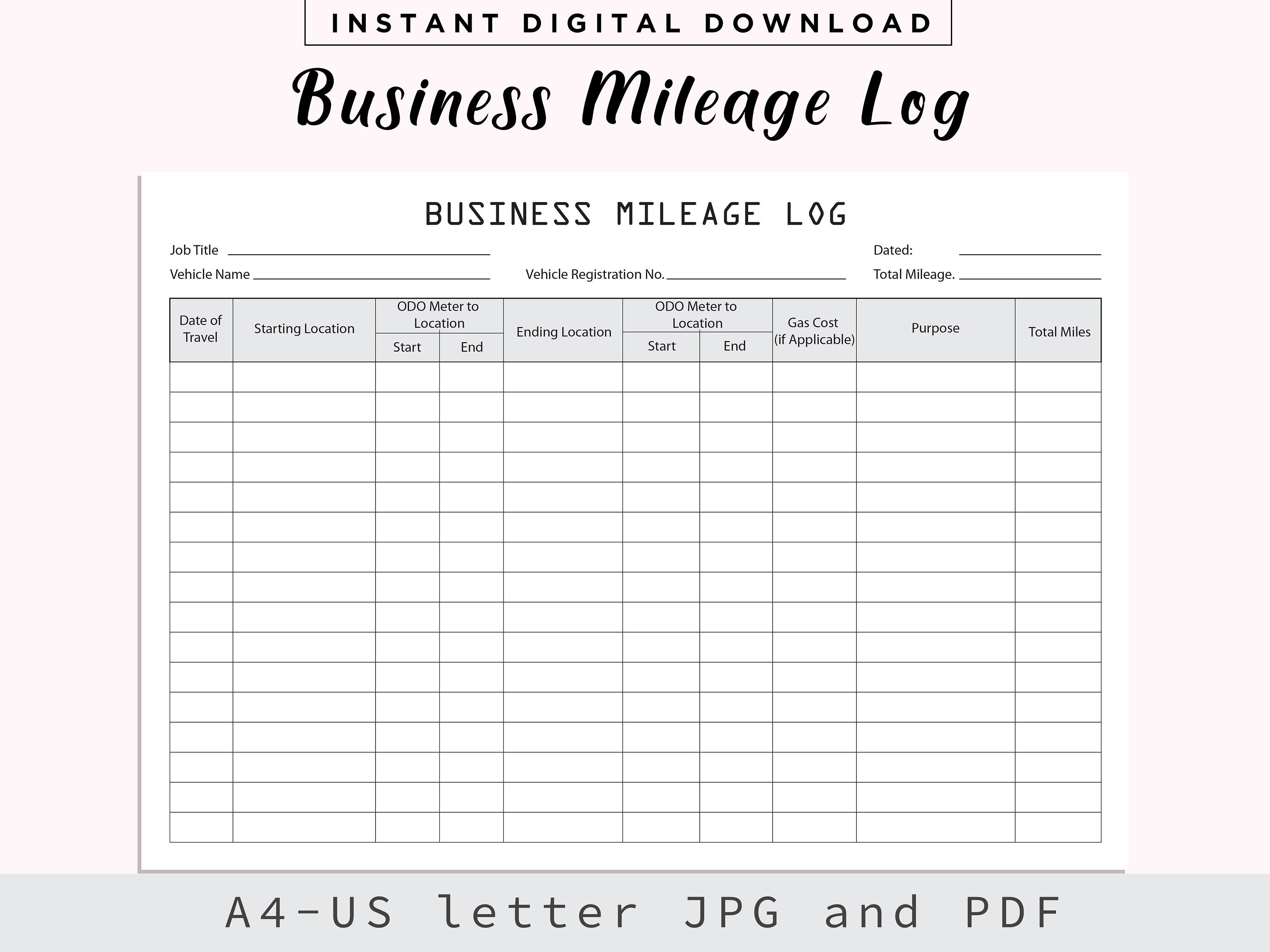

Workers will not obtain their compensations unless they send gas mileage logs for their business trips. Second, as previously specified, while by hand videotaping gas mileage is an option, it's time consuming and subjects the company to mileage fraudulence.While a typical gas mileage repayment can be kept up manual mileage tracking, a FAVR program calls for a service gas mileage tracker. The thinking is simple. FAVR repayments specify to each individual driving employee. With the ideal provider, these prices are computed through a system that attaches organization mileage trackers with the data that makes sure fair and accurate mileage compensation.

This substantiates the allocation quantity they receive, making certain any type of quantity they receive, up to the Internal revenue service mileage price, is untaxed. This also secures firms from prospective mileage audit threat., likewise referred to as a fleet program, can not potentially have demand of a service gas mileage tracker?

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

, "A staff member's personal use of an employer-owned automobile is considered a component of a worker's taxable revenue" So, what takes place if the worker doesn't keep a document of their service and personal miles?

The majority of service gas mileage trackers will have a handful of these functions. At the end of the day, it's one of the largest benefits a business obtains when adopting an organization mileage tracker.

Some Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Sending mileage logs with an organization gas mileage tracker ought to be a wind. Once all the info has been added correctly, with the ideal tracker, a mobile worker can submit the gas mileage log from anywhere.

See This Report about Mileagewise - Reconstructing Mileage Logs

Can you think of if a service mileage tracker application recorded every journey? Often mobile workers simply fail to remember to turn them off. There's no harm in recording individual journeys. Those can quickly be deleted prior to entry. Yet there's an also much easier service. With the very best gas mileage monitoring app, companies can establish their functioning hours.

The Mileagewise - Reconstructing Mileage Logs Diaries

This application functions hand in hand with the Motus platform to ensure the accuracy of each mileage log and repayment. Where does it stand in terms of the finest mileage tracker?

Intrigued in discovering more about the Motus application? Take a trip of our app today!.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

We took each application to the area on a similar path during our rigorous screening. We checked every monitoring mode and switched off the internet mid-trip to attempt offline mode. Hands-on screening allowed us to analyze usability and determine if the application was very easy or difficult for employees to make use of.

: Easy to useAutomatic mileage trackingMinimum tracking speed thresholdSegmented monitoring Easy to produce timesheet reports and IRS-compliant gas mileage logsOffline mode: Advanced tools come as paid add-onsTimeero covers our listing, thanks to its convenience of use and the performance with which it tracks mileage. You don't require to buy expensive gadgets. Simply request employees to install the mobile application on their iOS or Android smartphones which's it.

Comments on “About Mileagewise - Reconstructing Mileage Logs”